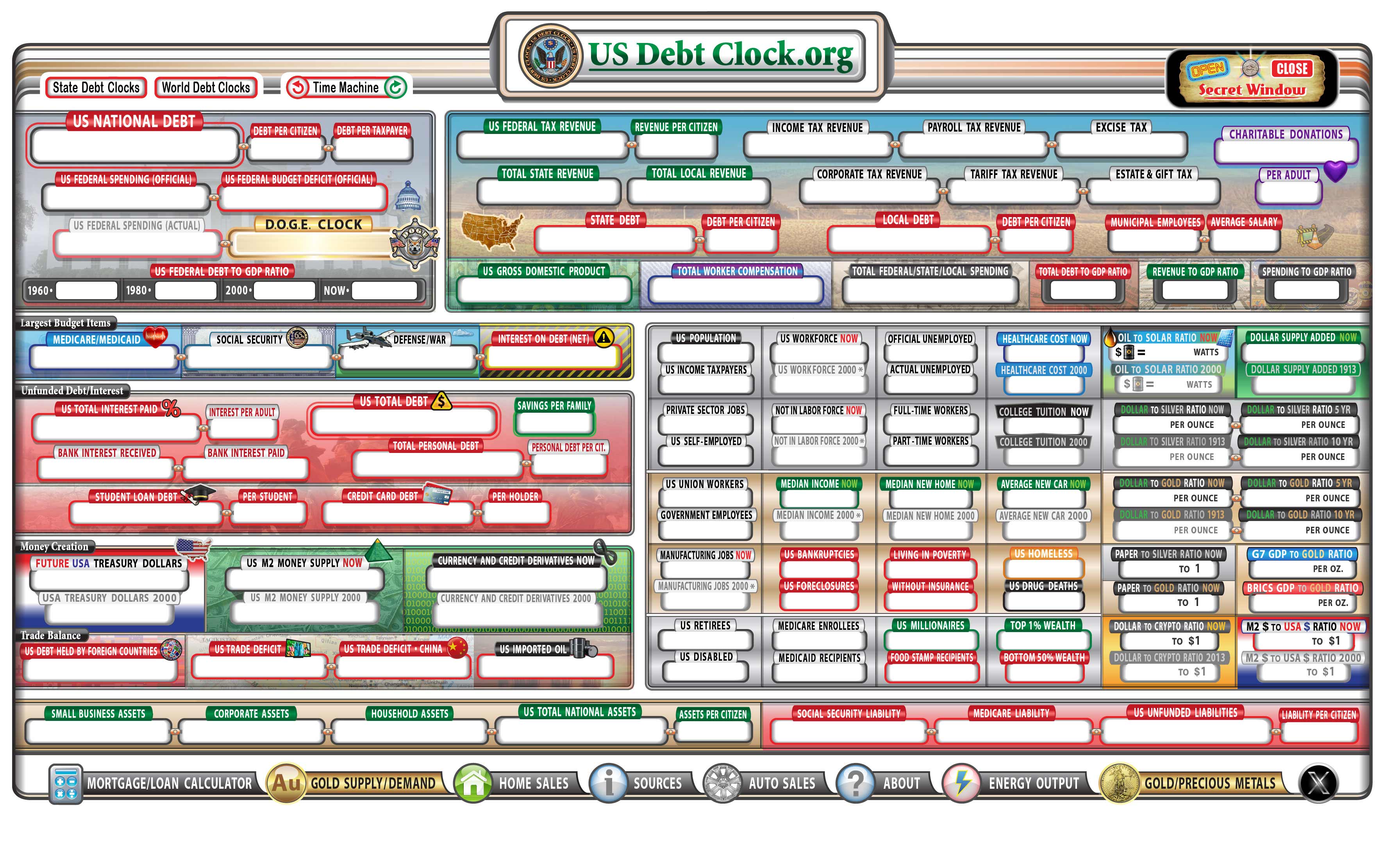

| Country (Population) | Total GDP (2023, USD) [Rank] | Per Capita GDP (2023, USD) [Rank] | Tax-to-GDP Ratio (%) | Budget Deficit (% of GDP) | Debt-to-GDP Ratio (%) |

|---|---|---|---|---|---|

| Philippines (115 million) | $394 billion [36th] | $3,667.57 [119th] | 14.6% | 7.3% | 61.3% |

| Indonesia (280 million) | $1.39 trillion [16th] | $5,000 [109th] | 11.9% | 4.5% | 39.4% |

| Vietnam (100 million) | $408 billion [35th] | $4,100 [115th] | 18.5% | 4.0% | 43.7% |

| Thailand (71 million) | $543.55 billion [25th] | $7,800 [93rd] | 15.3% | 3.7% | 61.9% |

Note: The figures are approximate and based on latest available data

Our Finances

Total GDP: Indonesia has the largest economy among the four, while the Philippines and Vietnam have similar GDP sizes.

Per Capita GDP: Thailand leads in per capita GDP, indicating higher average income per person, followed by Indonesia, Vietnam, and the Philippines.

Tax-to-GDP Ratio: Vietnam has the highest tax-to-GDP ratio, suggesting a more effective tax collection system relative to its GDP.

The tax-to-GDP ratio indicates the portion of the country's GDP collected as tax revenue. A 14.6% tax-to-GDP ratio means that tax revenues are 14.6% of the GDP.

Budget Deficit: The Philippines has the highest budget deficit as a percentage of GDP, indicating higher government spending relative to its income.

The budget deficit represents the shortfall between the government's total revenue (including both tax and non-tax revenues) and its expenditures. A 7.3% budget deficit means that the government's expenditures exceed its total revenues by 7.3% of the GDP. The difference between this and tax-to-GDP arises because the budget deficit accounts for all government revenues and expenditures, not just tax revenues.

Debt-to-GDP Ratio: Thailand and the Philippines have similar debt-to-GDP ratios, which are higher than those of Indonesia and Vietnam.

National debt is typically managed over extended periods, often spanning decades. Governments may refinance maturing debt by issuing new bonds, effectively rolling over the debt, while also aiming to reduce the debt-to-GDP ratio through economic growth and fiscal policies.

Our Budget

| Fiscal Year | National Budget (PHP) | National Budget (USD) |

|---|---|---|

| 2021 | ₱4.506 trillion | Approximately $90 billion |

| 2022 | ₱5.024 trillion | Approximately $100 billion |

| 2023 | ₱5.268 trillion | Approximately $105 billion |

| 2024 | ₱5.768 trillion | Approximately $115 billion |

| 2025 | ₱6.326 trillion | Approximately $109 billion |

Note: USD equivalents are approx. and based on average exchange rates during each fiscal year.

Our Debt

| Year | National Debt (PHP Trillion) | National Debt (USD Billion) |

|---|---|---|

| 2020 | ₱9.80 | $203.4 |

| 2021 | ₱11.73 | $234.0 |

| 2022 | ₱13.42 | $245.0 |

| 2023 | ₱14.15 | $250.0 |

| 2024 | ₱15.19 | $273.9 |

Note: USD equivalents are approximate and based on average exchange rates during each year.

As of October 2024, the breakdown is as follows: Total Outstanding Debt: ₱16.02 trillion ($276.27 billion) Domestic Debt: ₱10.89 trillion ($187.80 billion) External Debt: ₱5.13 trillion ($88.47 billion)

Our Funding

Governments fund their budgets through a combination of taxes, non-tax revenues, borrowing, money creation, privatization, foreign aid, and special contributions. Tax revenues come from income tax, VAT, excise taxes, property taxes, and customs duties, while non-tax revenues include fees, dividends from state-owned enterprises, fines, and royalties. Borrowing is done through government bonds, loans from international organizations, and treasury bills. In some cases, central banks buy government bonds, creating new money, which increases liquidity but may lead to inflation.

Additionally, governments can raise funds through privatization by selling state-owned assets, receiving foreign aid, and collecting social security contributions. The mix of these funding sources varies depending on a country's economic structure, fiscal policy, and political decisions.

Let there be . . . money!

Have you ever wondered how new money is created?

The BSP doesn't simply print money to finance government spending. Instead, it manages the money supply through tools like open market operations (buying and selling government bonds) and setting reserve requirements.

BSP buys government bonds

Imagine the BSP decides to purchase ₱1 billion worth of government bonds from Bank A [who bought them from the Bureau of Treasury). The BSP takes the bonds and, in return, increases Bank A's reserve account by ₱1 billion. Now, Bank A has more money to lend to businesses and individuals, which can stimulate economic activity.

BSP sells government bonds

Suppose the BSP sells ₱500 million worth of government bonds to Bank B. Bank B pays the BSP ₱500 million, which reduces the money Bank B has available to lend, thereby decreasing liquidity in the system and helping to cool down inflationary pressures.

Money Creation by Banks

Reserve requirements are regulations set by the BSP that determine the minimum amount of reserves a bank must hold against its deposit liabilities. When banks receive deposits, they are required to keep a portion as reserves and can lend out the rest. The money lent out often gets deposited into other banks, which can then lend out a portion of those deposits, and so on. This process multiplies the initial deposit, effectively creating new money in the economy.

If you deposit ₱1,000 in Bank C, with a 7% reserve requirement, the bank must keep ₱70 in reserves but can lend out ₱930. If the ₱930 is deposited into another bank, that bank can lend out 93% of it, and the cycle continues, expanding the money supply.

But of course—

While the BSP can create new money, it does so within a framework aimed at maintaining economic stability.

It’s not as simple as the BSP firing up the money printing press. Instead, new money gets into the system through a more intricate process involving banks and financial markets. By buying government bonds, setting reserve requirements, and managing lending activities, the BSP injects liquidity into the economy, giving banks more funds to lend. This, in turn, stimulates spending and investment, allowing new money to flow.

Right?